Ways to Monitor Your Ecommerce Site for Credit Card Fraud

[ad_1]

According to Michigan Retailer Association’s study of retail sales offered in its 2021 Purchase Nearby Analyze, national ecommerce income grew from 8.8 p.c of whole retail revenue in 2017 to 10.7 percent in 2019, and then jumped yet again to 13.6 % in 2020. While this data is really hard to delineate at a state-stage, there is no question that Michigan’s retail sector has very likely undergone a related transformation.

Amid the COVID-19 pandemic, adding ecommerce as a method for providing has been essential for numerous Michigan stores. Without it, a lot more suppliers would not have survived the pandemic.

As on the net gross sales improve, so does fraud

As a lot as vendors have benefited from ecommerce profits, on line credit score card fraud has jumped substantially throughout the U.S. In accordance to LexisNexis, U.S. ecommerce merchants noted a 140 per cent enhance in fraud assaults due to the fact 2020. On top of that, in accordance to a the latest report in Organization Insider, card-not-present (CNP) fraud is predicted to mature by 14 percent in the future four yrs.

One particular of the most frequent techniques cyber criminals get stolen credit score card quantities is by means of the dark world-wide-web. Most stop by a web page on the dark web and purchase stolen credit history cards in bulk with the aim of testing them to locate the types that get the job done. In 2019, there ended up at minimum 23 million stolen credit history card numbers for sale on the darkish world-wide-web. That number has only elevated due to the fact then.

What does this fraud mean to your organization? Consider far more chargebacks, penalties, lost income, and a new track record among the criminals that your enterprise is an easy goal.

I say this frequently: fraud avoidance is a journey, not a location. Cyber criminals are very refined and they modify solutions often and usually. There are, on the other hand, a few actions you can take that will enable you protect against fraud all through a transaction. They can expose a possible credit card theft in the generating.

- Do you acquire see if your terminal ordeals an EMV chip malfunction?

Though most of this short article is linked to ecommerce, one particular of the techniques that lousy men use stolen card numbers is by way of a experience-to-encounter transaction that is not “dipped” into the chip reader.

Whilst most retailers use an EMV chip reader, terminals are established up to allow for transactions to be processed employing a magnetic strip to accommodate more mature cards devoid of chips, or playing cards with malfunctioning chips. This is the loophole that criminals are now exploiting.

If a lousy male has a excellent card amount (and the related information and facts from the mag stripe), they can encode that on a legit card and then hurt the card’s EMV chip. This will drive your terminal to take a swipe (with the stolen card quantity on the mag stripe, rather of the legit card range).

When they make a obtain, they insert the card in the chip reader, which will report an error mainly because the chip simply cannot be read through. Then, they will inform the clerk that they are acquiring issues with the EMV chip on their card and ask if they can entire the transaction by either swiping the magnetic strip or possessing the clerk key in the account number, bypassing the EMV chip reader all jointly.

Take take note, you have to have to be vigilant with your workers about constantly utilizing an EMV chip reader. The big card networks have distinct guidelines about this. If a merchant allows a buyer with an EMV chip credit card to make a buy by swiping the card in lieu of employing the chip reader, any chargebacks submitted from the transaction will mechanically be discovered in the cardholder’s favor.

Alert your team to consider observe when this happens, particularly if it is a large-ticket variety such as jewelry, appliances, or a computer. If your EMV chip reader proceeds to are unsuccessful, it could be time to upgrade your method.

- Does your web site involve a a few-digit security code for all on the internet transactions?

In accordance to a 2021 Nilson Report on credit score card fraud, the volume of revenue shed to card-not-existing fraud in 2020 was 6 occasions increased than what retailers missing just a single 12 months earlier. For this reason the need to make absolutely sure that any buys produced on your web page involve a stability code.

A credit history card stability code, usually acknowledged as the card verification benefit 2(or CVV2) is the a few or 4 -digit code ordinarily observed on the again of a credit card. The CVV2 gives an added layer of security by verifying that the purchaser is in possession of the card.

To continue to be PCI compliant, you are not allowed to store CVV2 codes on your technique. This will help in protecting consumers from a knowledge breach and makes it difficult for cyber criminals to get a customer’s CVV2. Not complying with world PCI Details Stability Criteria could final result in significant fines or even even worse – the cancellation of your merchant processing accessibility by the payment processor.

- Does your web-site incorporate a CAPTCHA as component of the checkout approach?

One particular of the problems that lousy fellas have is figuring out if the card numbers that they bought on the darkish net are nonetheless energetic and “good.”

A widespread on the net procedure utilized by criminals is obtain internet sites to test a group of stolen cards by conducting low-volume transactions, normally $1 or $2 to locate the playing cards that are still energetic. This variety of account tests is regarded as “card tumbling.” A person of the significant consequences of becoming a target of a card tumbling assault like this is the significant service fees your account can happen if the scale of the attack is important. Some illustrations of costs include authorization, clearing and settlement, interchange, and gateway transactions.

Just about anything you can do to sluggish down the approach of receiving an authorization attempt on a transaction keeps card tumblers at bay. This is where including a CAPTCHA as aspect of your online checkout method plays a vital part. According to Dictionary.com, the origin of CAPTCHA stands for “completely automated community Turing check to inform personal computers and human beings aside.” It is a style of challenge-response exam used to identify regardless of whether the consumer is a human or a bot. To pass the exam, end users will have to interpret distorted textual content by typing in correct letters into a kind area. In the scenario of a re-CAPTCHA, the user is expected to determine a set of objects in a picture.

Whilst CAPTCHAs receive their truthful share of critics, they’ve performed a incredible occupation in defending ecommerce websites from brute power attacks.

As talked about at the commencing of this post, this system of shielding on your own is a journey, not a destination. It is one thing that you ought to be spending attention to on a regular basis.

As usually, if you have questions about this challenge or any other merchant processing concern, you should really don’t be reluctant to get hold of our client support group at 800.563.5981

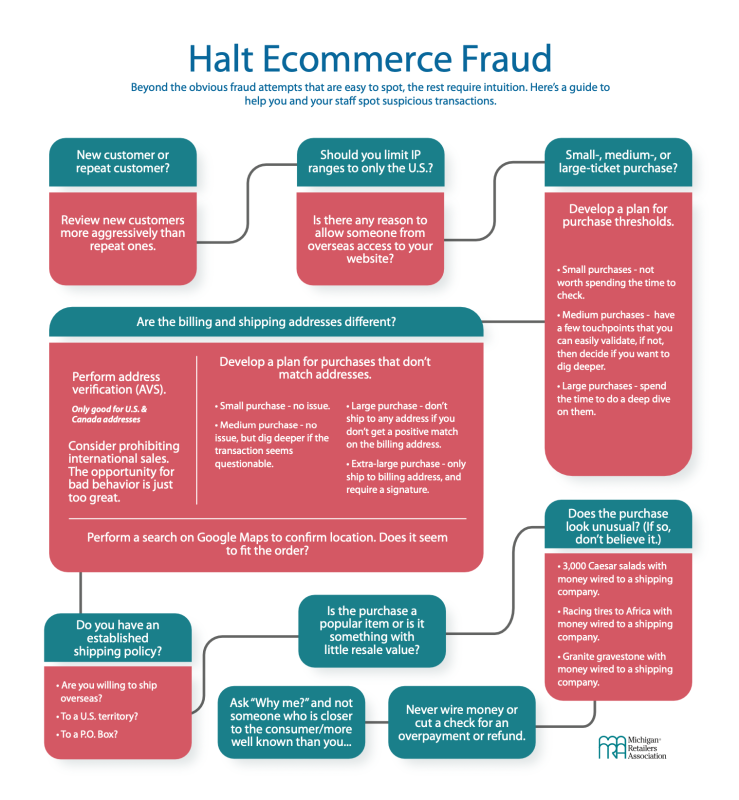

Use this Ecommerce Fraud Decision Tree graphic to help you and your employees place suspicious transactions.

[ad_2]

Supply connection